Market Due Diligence (For Acquisitions, Market Audits, etc.)

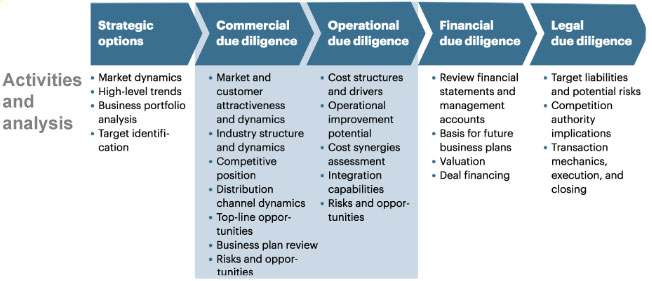

Research on successful acquisitions suggests that the most successful M&A teams are those which take an outward-focused, marketing type approach in their due diligence process (KPMG 2012). Most successful M&A teams spend from 30 to 50 percent of their time analyzing ‘non-accounting’ business issues such as the achievability of ‘sales-force related’ revenue synergies, savings to the cost structure and up-front integration costs. The sales and marketing due diligence (commonly referred to as commercialization due diligence) is a critical step in the entire due diligence process:

Acquirers need to bring marketing expertise early in the due diligence process so as to screen out less attractive prospects and to enable early planning of post-merger integration. Robert Hale and Associates creates realistic models of future sales, revenues and cash flows incorporating major risks such as losing customers through duplication or defections. In addition, various market related factors are assessed to include:

- Marketing and Brand Strategy

- Distribution

- Pricing

- Marketing Communication

- Competition

- Internal Sales and Marketing Issues

This information is obtained through potential acquisition data and interviews with company’s sales and marketing management as well as interviews with customers, suppliers, end users, business partners and industry analysts.